Introduction: Accelerating Toward an Electrified Future

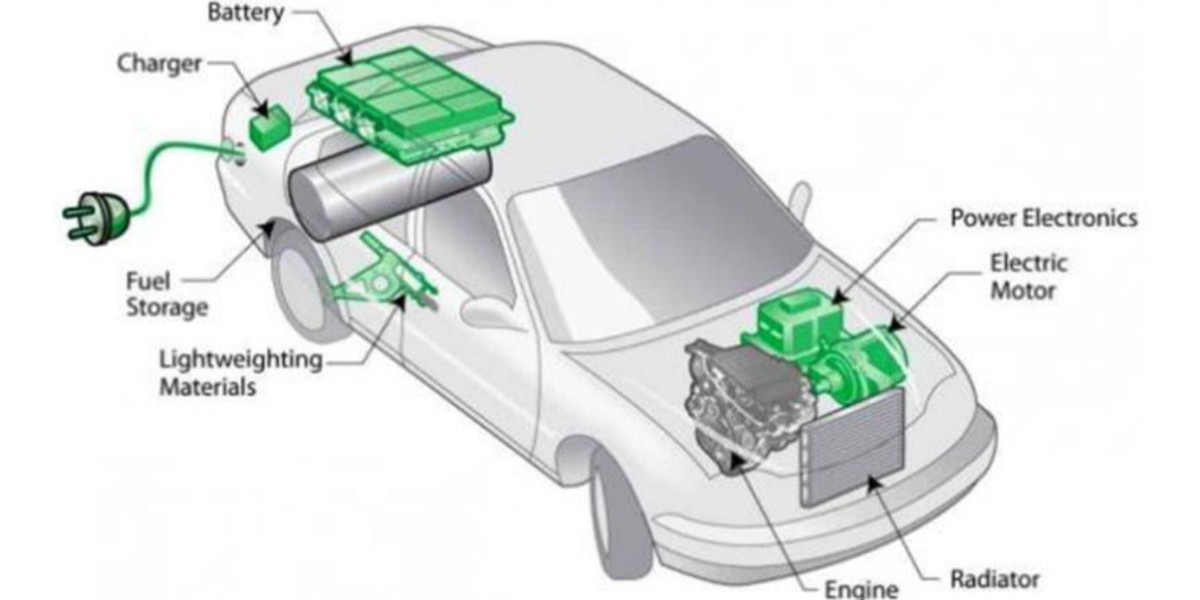

As the global automotive industry transitions rapidly from internal combustion engines to electrified powertrains, electric vehicles (EVs) are no longer a futuristic concept but a growing reality. Central to this transition is the power inverter — a vital component in EVs that converts DC power from the battery to AC power for the electric motor. Without this device, the seamless operation of EVs would not be possible. As electric vehicle adoption gains momentum globally, the demand for power inverters is increasing significantly, opening up a wealth of opportunities for manufacturers, suppliers, and technology developers in this specialized yet critical market.

Market Outlook: Rapid Expansion Ahead

The electric vehicle power inverter market is on an impressive growth trajectory, driven by rising electric vehicle sales, government incentives, and technological advancements in power electronics. According to a recent report from Persistence Market Research, the global electric vehicle power inverter market size is projected to rise from US$ 9.11 billion in 2025 to an estimated US$ 29.33 billion by 2032. This reflects an exceptionally high compound annual growth rate (CAGR) of 18.20% during the forecast period. This surge not only signals robust demand but also emphasizes the evolving importance of power inverters in enabling energy-efficient, high-performance electric mobility.

What is Driving the Growth of the EV Power Inverter Market?

Several interlinked factors are fueling the market's expansion. Foremost among them is the exponential increase in electric vehicle production. With automakers around the world launching new EV models and phasing out fossil-fueled vehicles, the demand for inverters is growing in parallel. Additionally, rising consumer awareness about clean energy, favorable government regulations, and incentives supporting EV adoption are accelerating market penetration. Advances in semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) are also improving inverter efficiency and performance, making EVs more competitive and practical.

What are the key opportunities in the electric vehicle power inverter market for manufacturers and investors?

The surge in EV adoption presents numerous opportunities in the power inverter market. Manufacturers can benefit by investing in high-efficiency inverter designs using wide-bandgap materials like SiC and GaN, which offer improved performance and thermal management. Customization for different EV platforms — including two-wheelers, passenger vehicles, and commercial EVs — is also in high demand. Additionally, investors should look toward companies developing bidirectional inverters, which enable vehicle-to-grid (V2G) integration, a promising trend for energy management and grid stability. Partnerships with automakers and innovation in compact, integrated systems will also unlock long-term value in this rapidly evolving market.

Technological Advancements: Improving Efficiency and Functionality

Power inverters have come a long way from bulky components to highly integrated, compact, and efficient systems. The shift from traditional silicon-based inverters to those using SiC and GaN semiconductors has enhanced power conversion efficiency, reduced heat losses, and improved the overall performance of electric vehicles. These advancements are crucial, especially as EV ranges increase and charging times shrink, requiring power systems to be more robust and reliable.

Moreover, integrated inverters that combine multiple power electronic systems into a single unit are becoming increasingly popular. These systems reduce vehicle weight, free up space, and simplify vehicle architecture — all while lowering production costs. Such innovations are driving market demand not just among automotive OEMs but also among Tier-1 suppliers and technology startups.

Segmental Overview: Where the Demand Is Coming From

The electric vehicle power inverter market can be broadly segmented based on propulsion type, vehicle category, inverter type, and region. Among propulsion types, battery electric vehicles (BEVs) hold a dominant share, thanks to their full reliance on electric powertrains and higher inverter requirements. Plug-in hybrid electric vehicles (PHEVs) also present considerable demand, particularly in regions where charging infrastructure is still developing.

When categorized by vehicle type, the passenger car segment leads due to sheer production volume and government mandates promoting consumer-level EVs. However, commercial vehicles — particularly electric buses and delivery vans — are expected to witness the fastest growth, driven by fleet electrification initiatives and urban transportation reforms.

In terms of inverter types, traction inverters account for the largest market share, as they are directly responsible for motor drive systems. Innovations in bidirectional inverters, which enable energy flow from vehicle to grid or home, are also gaining traction, opening new business models in energy management.

Regional Insights: Global Hotspots for Market Growth

Geographically, Asia Pacific dominates the electric vehicle power inverter market, with China leading the charge. The country’s massive EV production base, along with strong government subsidies, has made it a global hub for EV components, including power inverters. Japan and South Korea are also significant contributors, given their advanced semiconductor industries and proactive automotive R&D ecosystems.

North America is another key market, led by the United States, where growing environmental awareness and federal policies supporting EV infrastructure are boosting inverter demand. Tesla’s pioneering efforts and legacy automakers like Ford and GM launching EV models have significantly increased the regional appetite for high-performance inverters.

Europe, too, presents a highly promising landscape. With strict carbon emissions regulations and strong incentives for EV adoption, countries like Germany, the UK, and France are accelerating their shift to electric mobility. The European Union’s focus on climate neutrality by 2050 is further encouraging investment in EV components and technologies, including power inverters.

Challenges: Navigating Cost and Supply Chain Constraints

Despite its strong growth outlook, the electric vehicle power inverter market faces several challenges. Chief among them is the high cost of advanced inverter systems, especially those using SiC and GaN semiconductors. While these materials offer superior performance, their price points can be prohibitive for mass-market vehicles unless economies of scale are achieved.

Another significant challenge is the supply chain. Global shortages of semiconductors have already impacted the automotive sector, including power inverter production. Ensuring a steady supply of raw materials and maintaining quality control in manufacturing processes remain key concerns for both established players and new entrants.

Future Outlook: Innovations and Long-Term Potential

Looking ahead, the electric vehicle power inverter market is poised for sustained innovation. The integration of AI and machine learning in inverter control systems is likely to enhance energy optimization and fault detection. Similarly, digital twin technologies are being explored to simulate inverter behavior under various conditions, improving reliability and performance forecasting.

Another emerging trend is the modularization of inverter architecture. By creating adaptable and reusable inverter modules, manufacturers can cater to various vehicle models more efficiently, reducing time-to-market and costs.

As the automotive landscape shifts toward full electrification, including autonomous and shared mobility models, the role of inverters will become even more critical. Energy efficiency, real-time performance monitoring, and grid interaction will drive future development.

Conclusion: A Market Charged with Potential

The electric vehicle power inverter market is entering a transformative phase, fueled by rapid EV adoption, cutting-edge technologies, and global efforts toward sustainability. With the market size expected to grow from US$ 9.11 billion in 2025 to US$ 29.33 billion by 2032, at a CAGR of 18.20%, the opportunities are abundant. Industry players who focus on innovation, cost-efficiency, and strategic partnerships will be best positioned to lead in this evolving market. For manufacturers, investors, and policymakers alike, now is the time to plug into the electric vehicle inverter ecosystem and power the next generation of mobility.